Oxford Economics

The global metals and mining outlook through 2026 will be defined less by smooth price trends than by the interaction of investor behaviour, government policy, and China’s evolving role as both a demand anchor and a supply disciplinarian. While structural forces continue to support prices across several key metals, markets are increasingly prone to sharp, sentiment-driven swings. Investor positioning, policy uncertainty, and uneven industrial momentum are combining to create an environment in which volatility is not a temporary feature but a persistent condition. Against this backdrop, understanding the sources of price oscillation is as important as identifying the longer-term direction of travel.

Investor-driven oscillations will shape gold’s upward trend

Gold prices are set to continue rising through 2026, but the path will be far from linear. The forces that pushed prices to record highs in 2025—including robust safe-haven demand, elevated policy uncertainty, and sustained central bank accumulation—remain firmly in place and continue to anchor an upward trend. These structural supports have not weakened, even as the market’s behaviour has become more reactive.

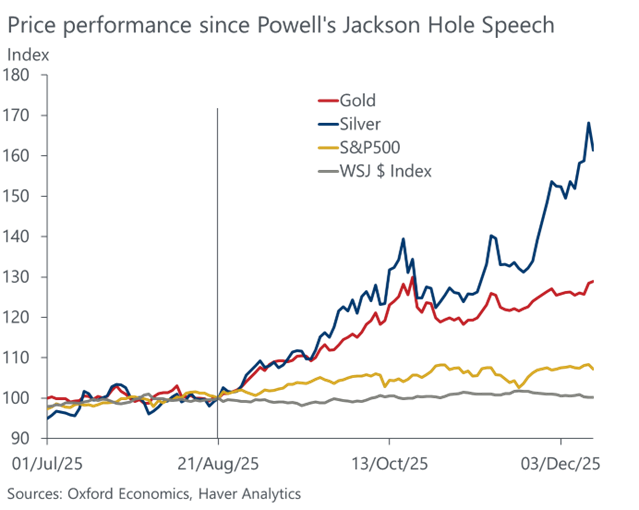

A key change is the growing presence of highly responsive investors. Throughout 2025, shifts in expectations around US Federal Reserve policy, intermittent gaps in US macroeconomic data, and heightened media attention have intensified fear of missing out during rallies. These dynamics have attracted additional buyers during upward momentum, while also setting the stage for abrupt pullbacks when optimism fades or price momentum stalls. Periods of heightened volatility elsewhere have sent investors searching for perceived value and stability, lifting silver alongside gold. At the same time, this cross-market turbulence has made investors more sensitive to incoming data and media narratives, amplifying price reactions around economic releases and policy commentary.

Despite this short-term volatility, longer-term buyers continue to provide a durable floor under prices. Central bank purchases, while likely to moderate from recent record levels, are expected to remain well above historical norms. These purchases are being driven by ongoing reserve diversification, wavering confidence in the US dollar, and a preference for assets that are resilient to political and financial pressure. Renewed inflows into gold exchange-traded funds reinforce this support, even as shorter-term speculative flows add volatility into the market.

China remains a key part of this longer-term picture. With significant scope for further reserve accumulation, and with broader concerns about US fiscal sustainability, gold prices are generally expected to keep rising. However, uncertainty around fiscal policy, trade relations, and monetary settings mean that investor-driven oscillations are likely to remain a defining feature of the gold market through 2026, and much the same applies to silver. The result is a choppy but ultimately rising price profile, shaped as much by sentiment and positioning as by fundamentals.

Chart 1: Prices are increasingly being moved above fundamentals by the news cycle

External policy will continue to shape metals markets

Government policy, particularly external trade, and industrial measures will determine several metals prices in 2026. Compared with early 2025, tariff uncertainty has diminished, and levels are unlikely to rise beyond existing announcements. This greater clarity does not eliminate policy risk, but it does change how markets are likely to respond.

In the US, imports of steel, aluminium, and secondary copper products will continue to be subject to Section 232 tariffs. There remains a risk that Grade A copper could also be targeted by import tariffs next year. If such measures are introduced, the most likely outcome would be a temporary price spike, like the reaction seen earlier this year when markets assumed raw copper would be included. However, high inventory levels in the US would be expected to limit the duration of any price surge, with prices easing back over subsequent quarters.

Looking into 2026, the indirect effects of tariffs are expected to play a more important role than direct price impacts. Weaker construction and manufacturing activity in the US, partly driven by trade-related costs and uncertainty, is forecast to weigh on demand. As a result, US domestic steel prices are set to soften in 2026.

For battery and rare-earth metals, industrial policy will continue to exert a powerful influence on prices. Oversupply persists in nickel and cobalt, but policy interventions are sustaining capacity and delaying the downward price adjustment that would normally accompany such oversupply. Measures such as Indonesian production quotas and US Foreign Entity of Concern rules are not eliminating excess supply, but they are altering the timing and pace of market rebalancing, extending periods of price weakness while preventing sharper near-term declines.

China will underpin demand amid tighter supply dynamics

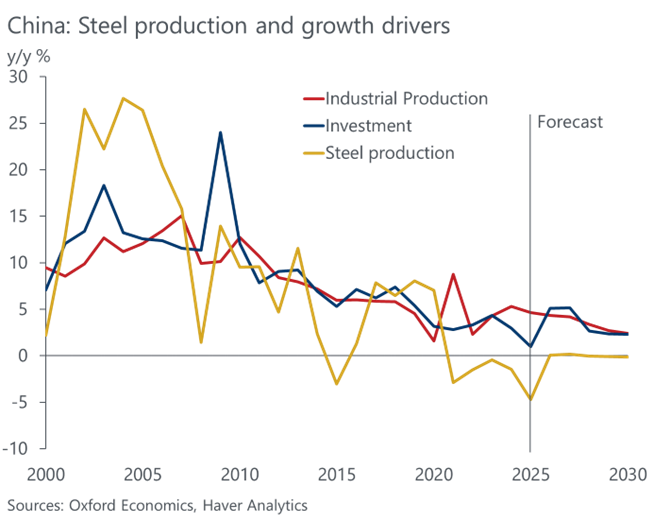

China will remain the dominant driver of global commodity demand in 2026, even as economic growth slows. GDP growth is expected to ease but industrial upgrading and the expansion of high-tech manufacturing are set to sustain solid demand for critical and base metals into 2026. The main drag remains the ongoing correction in the property sector weighing on ferrous metals demand.

Policy direction within China is also shifting the supply landscape. The government’s ‘anti-involution’ campaign aims to curb destructive price competition and encourage more rational investment behaviour. While this initiative is unlikely to deliver the deep supply-side reform needed to materially tighten markets, it is contributing to a more disciplined operating environment. Slower growth in metals output should help support prices once global industrial activity begins to strengthen in the second half of 2026.

In steel, production has already fallen below 1 billion tonnes this year, despite the absence of explicit output curbs. Weak domestic demand and multi-year low prices have naturally constrained production. Although rising exports provide some relief, they are insufficient to offset domestic weakness. As a result, only a modest rebound in prices and output is expected next year.

Aluminium presents a more structural shift. Capacity is approaching the 45-million-tonne ceiling, signalling a shift away from the expansion-led model that underpinned China’s supply dominance for much of the past decade. While this cap could technically be revisited, current policy direction points toward stricter discipline in energy-intensive sectors. This increases the likelihood of a transition from global surplus to structural deficit, placing upward pressure on prices from next year.

More cautious supply signals are also emerging in other non-ferrous metals. In copper, rapid growth in refined output has outpaced demand and concentrate availability, squeezing margins. While production is expected to continue rising next year, the pace of growth should slow. This moderation means that the global copper market is likely to shift into deficit.

Chart 2: China’s economy continues its structural cooling

A volatile but directional outlook

Across metals markets, the outlook in 2026 will be characterised by tension between structural support and short-term volatility. Investor behaviour, particularly in precious metals, is amplifying price swings, even as longer-term fundamentals remain constructive. Government policy is shaping market outcomes by delaying adjustment rather than preventing it, while China continues to anchor demand and increasingly constrain supply growth. The result is an environment in which prices are likely to move unevenly, but where underlying trends remain intact—rewarding those able to look through volatility and focus on the forces shaping the medium-term balance.

Stephen Hare has covered industrial metals for 8 years, while Sebastien Tillett has covered precious metals for 2 years. Both are members of the commodities practice at Oxford Economics, a leading global economic advisory firm.